Online accounting solutions are huge assets in making the lives of SMBs (or any kinds of businesses) easier. However, there is a feature that still can be considered a black sheep, even though it’s one of the most important parts of accounting: payroll. Thankfully, the best-known accounting solution providers have recognized the importance of payroll, building it into their cloud-based software. This way, employees can not only manage their own work schedule using time trackers, but they can also get paid through the very same program. Furthermore, the lack of a payroll feature is not a hindrance anymore. Thanks to API support, you can integrate many different payroll applications into your accounting solution and make payday and payroll tax filing a hassle-free, fully-automated process.

One of the best things about payroll is that it auto-manages the entire process. All you have to do is to either enter the timesheet of your employees, ask them to submit their own timesheets, or use a built-in/integrated time tracker, and then the accounting software will take care of the rest. In fact, the payroll feature can also handle ‘deviations’ in the regular payroll schedule, like vacations, sick leave, and bonuses, as employees can individually apply for leave even when they are out of office. Employees are also entitled to receive their individual payroll reports, which you can also give to your accountant – who can have full access to your payroll to help you verify data in preparation for tax season.

Speaking of taxes, not only does the software calculate the taxes you have to pay (and in some cases even allows you to file tax reports right away), but it can also remind you when payday is due and give you the option to decide how you’d like to pay your co-workers.

Unfortunately, payroll is a feature that not every online accounting solution provides. However, what these programs can do for you is offer the option to integrate a third-party app with your software, so you can manage payroll after all. In fact, some of these apps are capable of something the built-in payroll solutions of accounting software aren’t: auto-filing the necessary tax reports in every U.S. state. Furthermore, each time you run payroll, it reduces the chance of manual errors and common mistakes by removing duplicate entries that might have been left by calculating ordinary hours, penalty hours, overtime and allowances – making the end of the month completely hassle-free.

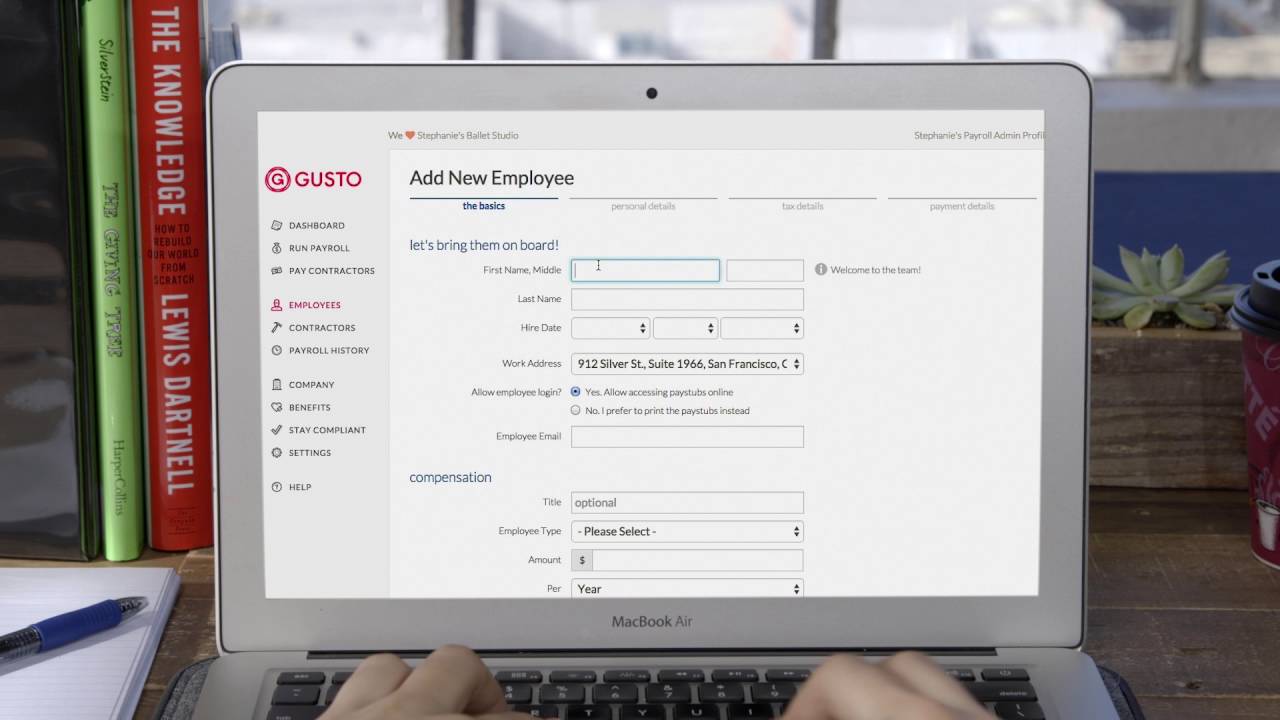

Although there are plenty of third-party applications supported by online accounting solution providers, one of the most popular third-party payroll services is Gusto. The app automatically calculates, files, and pays your taxes – it even adds insurance costs and prepares your 1099s.

Not too many online accounting solutions have built-in payroll features, or if they do, they are often pay-only. However, if you want to make sure that everything is in one place, or you want to replace the existing payroll feature with a huge variety of third-party add-ons, then Xero and QuickBooks Online, two of the market leaders, might be your best option.

Xero is a progressive and innovative online accounting solution that enables you to manage your accounts more effectively and make your accounting hassle-free. Some of its features include invoicing and quotes, bank reconciliation, inventory, mobile capability, third-party apps, purchase orders and payroll. The mobile version of the software, Xero Touch, makes it possible to access all your accounting data instantly from wherever you may be. Xero integrates and works well with many other third-party applications (such as advanced solutions for CRM, point-of-sale, e-commerce and more). You have a choice of three pricing plans – Starter, Standard and Premium – all of which have slightly different features and a reduced price for the first six months. Xero also provides a 30-day free trial. Customers enjoy efficient and reliable support from Xero online teams. Xero’s US headquarters is in San Francisco, but this publicly listed company’s products are used in over 180 countries. The company has garnered impressive experience in the area of cloud computing and accounting and has continued to innovate and create new products for the market.

It is quite unbelievable that U.S.-based online accounting company Intuit Inc. has already been on the market since 1983. But the success of its main product, QuickBooks Online shows that they aren’t just simply lucky. The software exists as downloadable software for desktops, and a cloud-based accounting solution dubbed QuickBooks Online, which the company quite aggressively promotes. This latter version, of which we will be talking about, is ideal for everybody from simple sole-proprietors to bigger companies. Regardless of the chosen subscription, you can create invoices, expenses, and estimates with a few clicks, quickly manage sales receipts, create and print checks, payrolls, have multiple tax rates, real-time banking and reports. You can integrate the software with over 300 third-party solutions, and be entitled to full customer support. You also have the option to try out the software completely free of charge for 30 days. Skipping this trial period you get a discount from the monthly subscription fee for six months or a whole year. But if you don’t like the software, you still have a 60-day money back guarantee.

The Best Reviews team researches and tests all products first-hand. We've been reviewing products and services since 2012 and are proud to only publish human-created content.

Share your thoughts, ask questions, and connect with other users. Your feedback helps our community make better decisions.

©2012-2025 Best Reviews, a clovio brand –

All rights

reserved