For many taxpayers, online tax software offers them nothing but convenience. But, sadly, the truth is that they can also be the source of major headaches: online tax programs are ideal targets for wrongdoers since they handle highly sensitive financial and personal information over the internet. Simply put, applying certain safety measures to secure these details is a must but, thankfully, tax programs are well-prepared for all sorts of attack against their clientele. All this protection is worth nothing without the taxpayers themselves, however and, in fact, it’s them who can do the most to protect their tax data.

Since online tax solutions have to deal with highly sensitive data, all of them are equipped with multiple layers of security. First and foremost, the data facilities of these tax companies are constantly monitored and maintained to ensure an uninterrupted service at all times. The programs themselves use bank-level encryption to protect user data, which is by far the most secure encryption method used for commercial services.

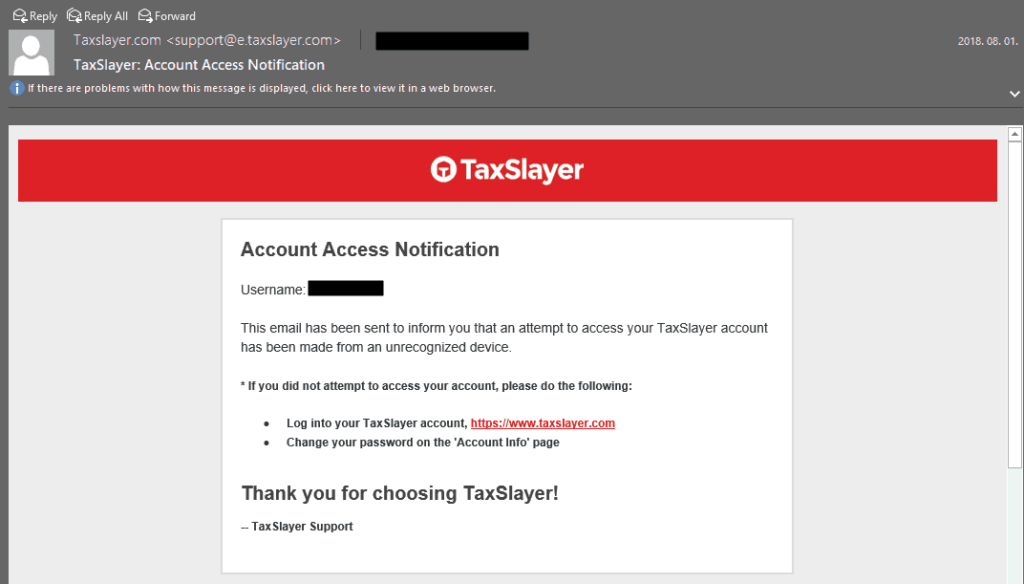

Although some tax companies usually stop there, the market leaders often up the ante by providing further layers of security such as with two-factor authentication or by simply sending automated email messages to users whenever important data like their Social Security number is changed. In fact, the supplied SSN is often checked multiple times by the program to ensure that it’s valid and hasn’t been used by someone else to avoid tax fraud in the unsuspecting taxpayer’s name.

It’s one thing that tax companies are required to safeguard their users’ accounts, but they can only do so much; the only way to make sure that all sensitive information is protected is if users actively contribute to securing their own data in the following ways:

Although it’s tempting to do a simple Google search in the hopes of coming across a suitable tax prep solution, it’s better to be smart about the choice and only use trustworthy services that comply with the minimum requirements for data protection. Simply put, services that don’t encrypt data with bank-level standards or are incapable of alerting you to important changes made to the account should be avoided at any cost.

By signing up to an online tax prep service, users are often giving consent to the company to store their data and/or forward it to third parties, including the IRS. Although your data is only used to either improve the tax company’s services or to complete processes like forwarding your credit card information to the card processor, it’s still best to take a quick look at the privacy policy before creating an account and see what kind of information is shared and with who.

Admittedly, the default security settings of tax programs are usually enough to secure sensitive information like the SSN, but if it’s obtained from someplace else then nothing can stop criminals from committing tax fraud. Thankfully, this can be prevented by adding the ID theft protection service to your package. By having this perk on board a dedicated team will monitor the internet for suspicious activity and should go wrong in this regard they’ll make sure that the victim won’t end up being fined by the IRS.

It’s certainly a huge asset that online tax programs can be accessed from anywhere, but this isn’t without its risks. In fact, logging into the software from an unsecure network without turning on a VPN first – which hides the user’s internet activity so it can’t be tracked – could easily result in sensitive tax data being sniffed out.

Additionally, taxpayers can fall victim to the dreaded phenomenon of shoulder surfing, too. To avoid this, it’s obviously a smart idea to refrain from accessing the tax software in public places and, for that matter, in your workplace as well, especially if anyone can see what you’re doing.

Relying on the default security settings of the account is one thing but the only way to properly protect the account is via a strong password. Thankfully, coming up with an unbreakable password isn’t too complicated, especially if a password manager is used. In fact, a password management program is by far the best option for tax software users as it will store all logins in a safe vault and encrypt them until they are entered into the tax program’s login screen.

Share your thoughts, ask questions, and connect with other users. Your feedback helps our community make better decisions.

©2012-2025 Best Reviews, a clovio brand –

All rights

reserved