Positives

- User-friendly

- Thorough support page

- Free registration

- Reduceable transfer fees

- Rate alerts

Negatives

- Lengthy registration

- No dedicated desktop app

It’s not an overstatement to say that running a business comes with huge responsibilities. This is especially true when it comes to the company’s finances, which can be a common source of stress. From salaries to big investments, if there’s just one mistake in the numbers, the losses can be so enormous that the whole company can collapse like a house of cards. Thankfully, Instarem is here to help. The service not only simplifies money transfers but also provides absolute transparency, meaning that nothing happens without you knowing it. All this is free and you only pay for transactions. Even then, prices are fairly reasonable and can be further reduced with the accumulation of InstaPoints.

Features

No matter the size, a business always has its fair share of costs. Employees and business partners need to be paid, and tax officials may be knocking at the door because they haven’t received the VAT for your latest invoice. Many transactions happen overseas, where it makes a difference if the sender is transferring money in one currency and the receiver is receiving the amount in another. This is where Instarem comes in – with minimal fees and low foreign exchange (FX) rates, the user will quickly realize that the age of time-consuming and money-draining transfers is dead and gone.

Not only is the service user-friendly and cost-effective, but transferring money is fast and reliable as well, where the transferred money typically arrives instantaneously. The process is safe, too, as the company maintains complete transparency – transfers can be tracked and easily checked that they arrived at the right account.

Money Transfer

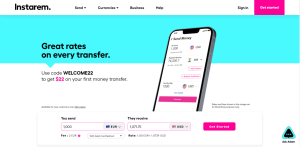

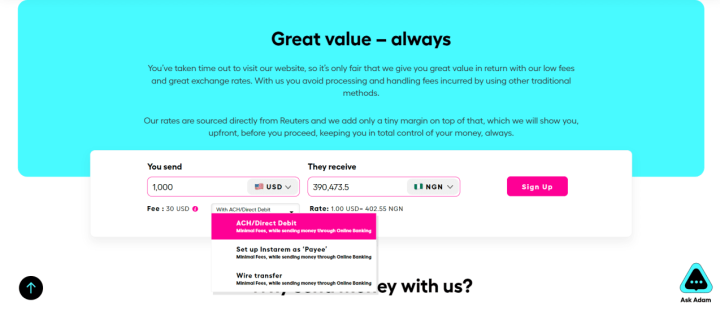

Instarem specializes in sending money overseas. As such, the service supports a plethora of currencies, allowing to send money to almost anywhere in the world. Imagine you’re sending $1,000 from the U.S. to Nigeria. The app shows you the money conversion instantly, along with the associated fee. If the exchange rate is USD 1 to NGN 402.55, the amount the Nigerian partner receives is NGN 390,473.50, resulting into a $30 fee. This can be paid to the receiver’s bank through ACH/Direct Debit or wire transfer (the same way bank transfers work). Alternatively, Instarem can be set up as the payee, meaning that the fee goes through Instarem first, and they’ll take care of everything. Note that this method may slow down your first transfer, but the process becomes smooth after that.

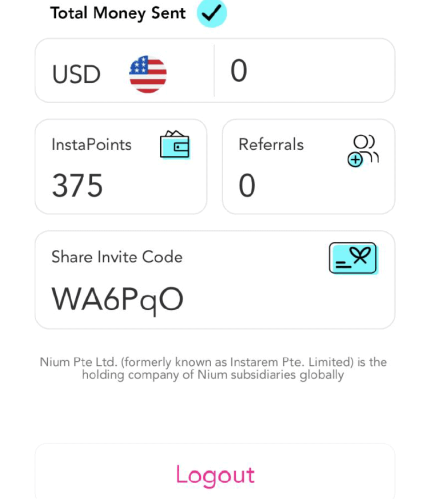

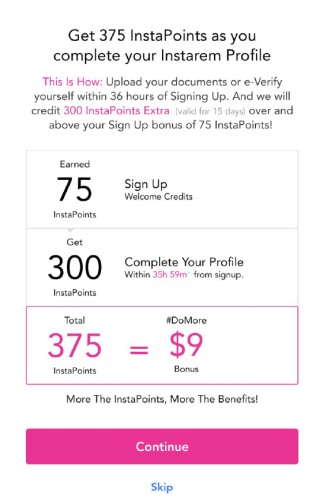

Transfer costs can be reduced with InstaPoints. The company is extremely generous with these, offering them on the completion of your Instarem Profile. This requires the user to verify their identity either by uploading the relevant documents or through e-verification. The process yields 300 InstaPoints, which combined with the 75 welcome credits, are worth $9. Using the previous example, these InstaPoints would reduce the fee for sending USD 1,000 to Nigeria from $30 to $21. Additional InstaPoints can be acquired through the referral program, where both the referral and the referee receive credits. Finally, large transactions yield InstaPoints too.

Rate Alerts

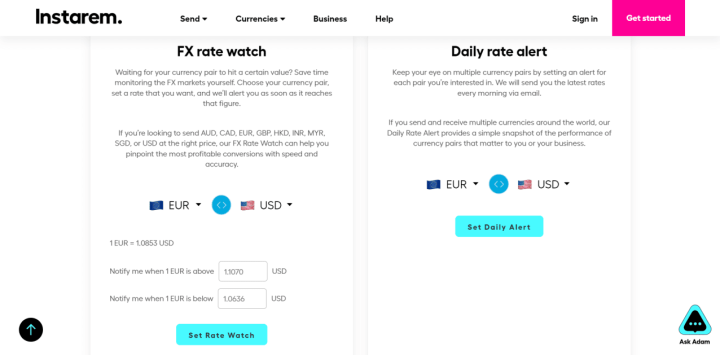

Sending money overseas is indeed crucial when an entrepreneur works internationally. But since inflation and interest rates are always changing, the numbers are anything but constant. In other words, you need to keep an eye on them at all times. This is where Instarem and its two rate alerts come in, both able to monitor exchange rate fluctuations.

Small and medium-sized businesses are likely to have a limited number of partners abroad, meaning that most overseas money transfers are only in a handful of currencies. As such, monitoring a currency pair like the relationship between USD and NGN, may be extremely handy. For this, Instarem offers its FX Rate Watch, designed specifically for monitoring changes in one chosen currency pair. If you’re based in the U.S. and plan to regularly send money to Nigeria, you can set it to notify you when the FX rate for that pair is below a certain threshold.

Instarem’s Daily Rate Alert works similarly, but instead of focusing on just one currency pair, it sends you daily emails concerning several preselected currency pairs. This comes in handy when your company starts growing and the number of foreign partners grows along with it.

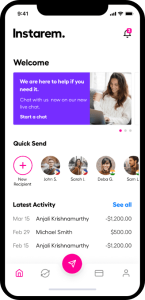

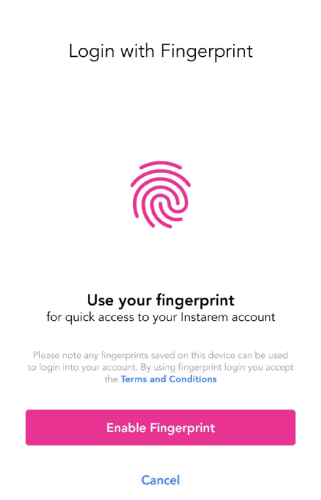

Mobile

Instarem doesn’t have a dedicated desktop app but using the service online is simple enough. If sitting down to handle money transfers is not an option, the good news is that the service is designed for those who mostly make transfers on their mobile device. The dedicated Android and iOS apps are extremely convenient, as it’s essential to be able to send money on the go – and an entrepreneur is always on the go. But it’s not necessary to download the mobile app, as Instarem’s website is mobile optimized as well.

Instarem doesn’t have a dedicated desktop app but using the service online is simple enough. If sitting down to handle money transfers is not an option, the good news is that the service is designed for those who mostly make transfers on their mobile device. The dedicated Android and iOS apps are extremely convenient, as it’s essential to be able to send money on the go – and an entrepreneur is always on the go. But it’s not necessary to download the mobile app, as Instarem’s website is mobile optimized as well.

Pricing

Instarem’s prices are simple. First, and most significantly, signing up for an account – as well as the two rate alerts – is free. Registration is a lengthy process, where you have to give your personal and banking details, and upload plenty of documents, but that’s forgivable considering you don’t pay a dime.

What needs your attention is the cost of transferring overseas. The fees change according to how much you’re sending, where to, and in what currency, and Instarem can lock the exchange rates to the day of the transfer. Sending to more countries also brings fewer transaction costs, and the amount can be further reduced with InstaPoints. Finishing the registration in any given timeframe yields 375 points and a referral 400 more, meaning that you have everything you need to get a good head start.

Perhaps the simplest solution when paying fees is setting up Instarem as a payee. This way, Instarem pays the partner on behalf of the sender after receiving an advance payment. But if that’s a no-go, credit card or regular wire transfers are also options.

Pricing

Customer Service

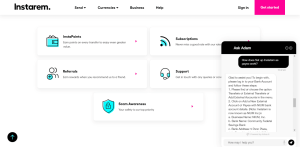

Only good things can be said about Instarem’s customer service, which is available 24/7. Apart from regular channels like social media sites and an email address, Instarem’s live chat support is always ready to help in the bottom right corner of its website. The moment a question is sent, tons of possible answers arrive with relevant FAQ sections attached. If you have a specific question, such as how to set up Instarem as a payee, you’ll receive a thorough and detailed answer before you even have time to say ‘currency’.

Only good things can be said about Instarem’s customer service, which is available 24/7. Apart from regular channels like social media sites and an email address, Instarem’s live chat support is always ready to help in the bottom right corner of its website. The moment a question is sent, tons of possible answers arrive with relevant FAQ sections attached. If you have a specific question, such as how to set up Instarem as a payee, you’ll receive a thorough and detailed answer before you even have time to say ‘currency’.

Speaking of FAQ sections, Instarem provides one of the most thorough support pages out there. Starting with general information about the company, and then going deep on several topics, such as payments and currencies, Instarem offers detailed answers laid out in simple, understandable language. It’s likely that any question you can think of has already been asked at some point, and the answer is there just waiting to be found.

Bottom Line

Instarem is a no-brainer money-transfer service for small and medium businesses, and more than optimal for individuals as well. With its easy-to-use online interface, transferring money overseas has never been quicker. Being able to convert most currencies for a small fee makes Instarem an extremely diverse service. With its exceptionally comprehensive support page, FAQ section, and live chat, it’s easy to learn almost everything before you even start transferring. It’s just the icing on the cake that transfer fees can be reduced through InstaPoints and that the exchange rate changes can be easily tracked. It wouldn’t hurt if the registration process was quicker to complete, but a money transfer service must cover all angles, and for that, it has to thoroughly check every document. The lack of a desktop app may also be a downside for some. Still, the mobile apps more than make up for that, and using the service online is as simple as it gets.

Instarem is a no-brainer money-transfer service for small and medium businesses, and more than optimal for individuals as well. With its easy-to-use online interface, transferring money overseas has never been quicker. Being able to convert most currencies for a small fee makes Instarem an extremely diverse service. With its exceptionally comprehensive support page, FAQ section, and live chat, it’s easy to learn almost everything before you even start transferring. It’s just the icing on the cake that transfer fees can be reduced through InstaPoints and that the exchange rate changes can be easily tracked. It wouldn’t hurt if the registration process was quicker to complete, but a money transfer service must cover all angles, and for that, it has to thoroughly check every document. The lack of a desktop app may also be a downside for some. Still, the mobile apps more than make up for that, and using the service online is as simple as it gets.

Share Your Review