Positives

- Free account

- Up to 4% p.a. reward

- Free SEPA Transfers (5/mo)

- High cash limits

- Available for teenagers

Negatives

- No deposit insurance

- Expensive outside of the EU

- Inactivity fee

Blackcatcard is a straightforward mobile and online banking service with a free IBAN account, payment cards, cashback, and crypto features. Creating an account with a European IBAN couldn’t be easier. While payments in currencies not included in Blackcatcard’s list incur a 3% fee, you’re able to use the card entirely for free within the European Economic Area (EEA) with only a few limitations.

The online platform and mobile app are also extremely easy to use, and Blackcatcard provides a secure way to transfer money, make payments, and trade crypto for euros. The best part is that there are several cashback programs* to choose from, as well as various special discounts on offer.

Features

Blackcatcard is issued by Papaya, Ltd., which is licensed by the Malta Financial Services Authority as an Electronic Money Institution (EMI). This is key information, as EMIs are not protected the way banks are. For example, if Papaya closes its doors, the government doesn’t guarantee you get your money back as it does with banks. Being an EMI also means that Blackcatcard (or Papaya) can’t lend money to clients, which explains why it provides a rechargeable prepaid card and doesn’t offer credit.

Blackcatcard is issued by Papaya, Ltd., which is licensed by the Malta Financial Services Authority as an Electronic Money Institution (EMI). This is key information, as EMIs are not protected the way banks are. For example, if Papaya closes its doors, the government doesn’t guarantee you get your money back as it does with banks. Being an EMI also means that Blackcatcard (or Papaya) can’t lend money to clients, which explains why it provides a rechargeable prepaid card and doesn’t offer credit.

In addition to the typical banking services, Blackcatcard also offers a built-in partner crypto service**, where you can store cryptocurrencies, make transactions, and withdraw in euros. Technically, anyone can open an account with Blackcatcard, but the payment card is only available for customers with proof of address in the EEA. Still, crypto services and European IBAN accounts are available to people outside this location.

More Coupons, Discounts, and Promo Codes

Core Banking Services

As an EMI, Blackcatcard provides standard core banking features of depositing, transferring, and withdrawing money. Options requiring the institution to mix customers’ money like banks do, such as with loans, are unavailable.

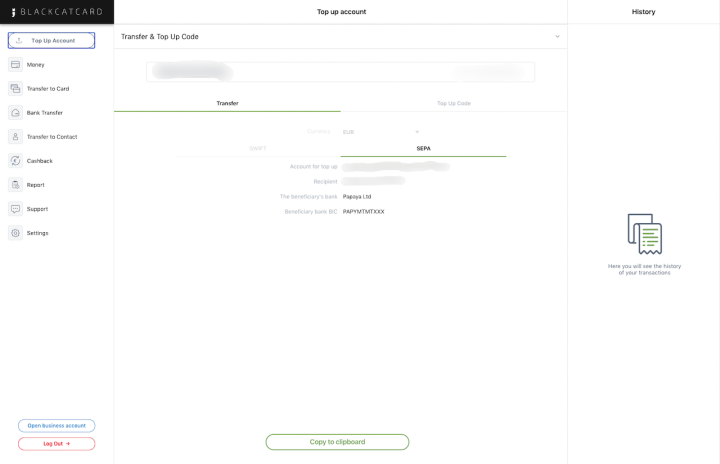

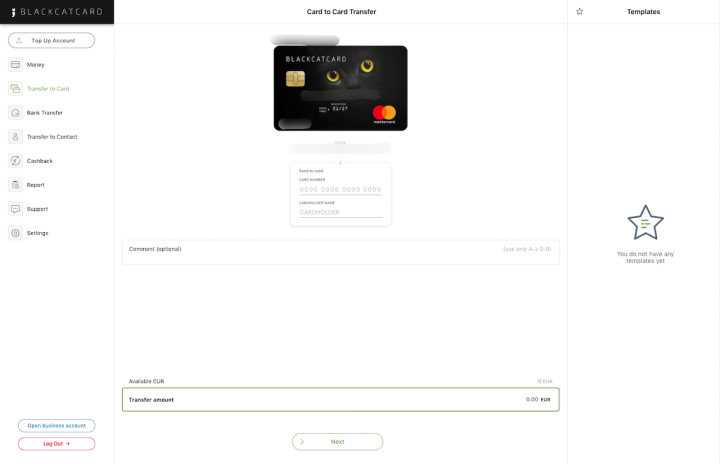

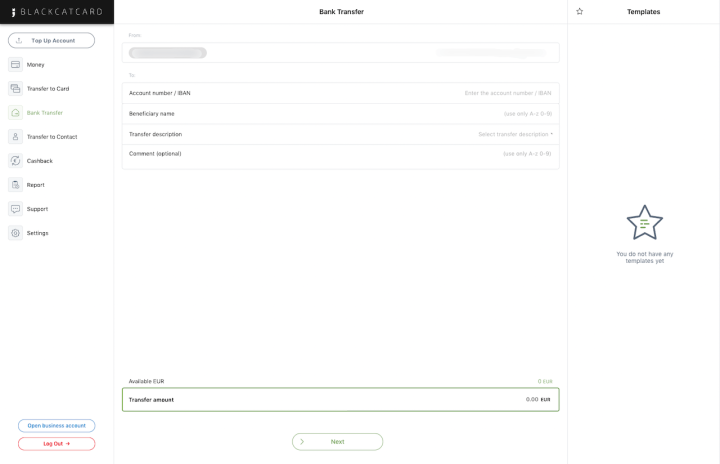

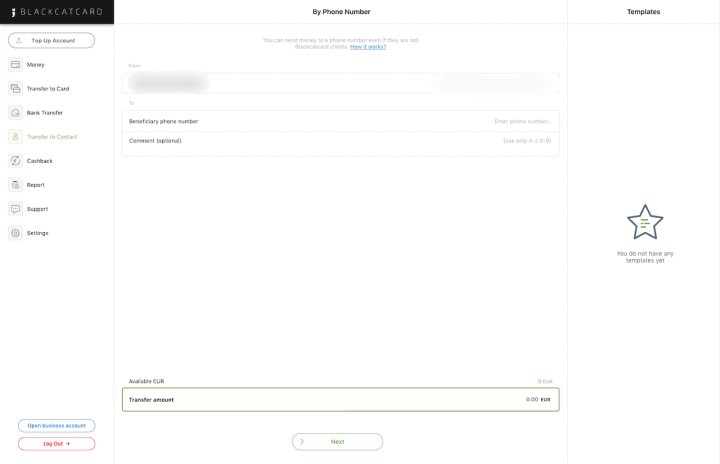

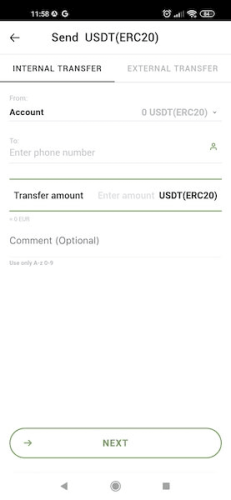

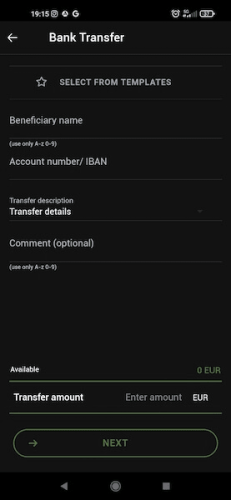

There are four ways to transfer money with Blackcatcard: SEPA transfers, card-to-card payments, contact list transfers, and crypto transfers. Most of these transactions are free, with certain limitations that are further discussed in the pricing section.

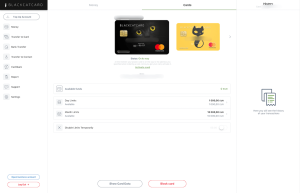

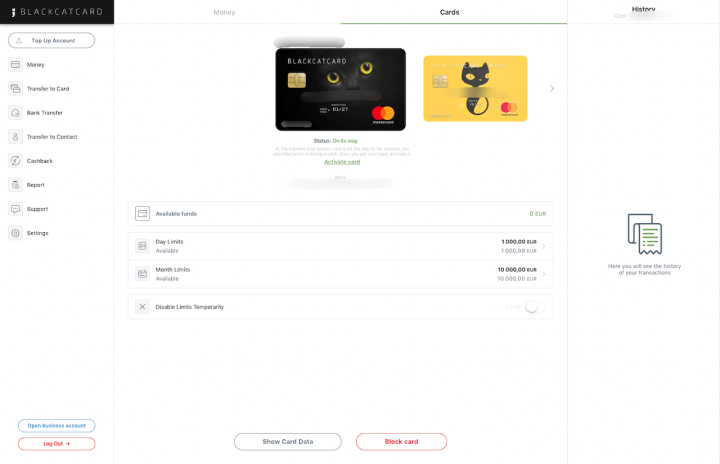

The payment card is Contactless, and works with all types of payment terminals. For security reasons, the contactless feature is blocked when you make more than five consecutive transactions or when they exceed a total amount of €150. As the name implies, the cards have a premium feel by being utterly black with two luminous cat’s eyes looking over your money. The first is free, but you can get unlimited additional cards for an extra fee.

Anyone over 16 can open an IBAN account without parental supervision – perfect for teenagers who want financial freedom to spend their allowance or earnings. Additionally, parents who wish to teach their children financial literacy can get Blackcatcard Kids. This card is associated with your account, and the mobile app allows you to control its spending.

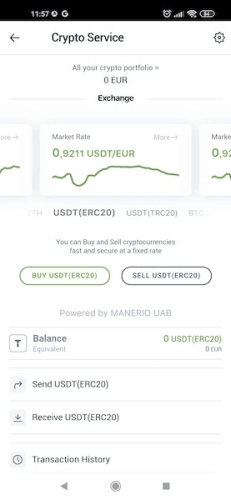

Built-In Partner Crypto Service

Blackcatcard also provides a built-in partner crypto service where customers can securely buy, sell, send, receive, and store their digital assets. Everything is in the same mobile app, making it extremely easy to manage cryptocurrency.

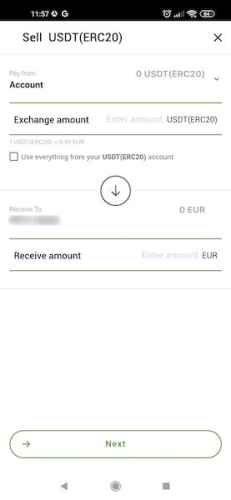

The wallet supports several digital assets, including Bitcoin, Ethereum, and Tether. The best part is that it only takes a few taps for you to turn your cryptocurrency into euros, which are added to your IBAN account. Moreover, P2P crypto transfers made with Blackcatcard don’t have any blockchain fees, and you can send (and receive) crypto to someone in your contact list using their phone number.

However, be aware that external transfers incur a fee, which changes depending on the cryptocurrency. There’s also a limit of €2,000 per day and €10,000 per month for buying and selling cryptocurrencies.

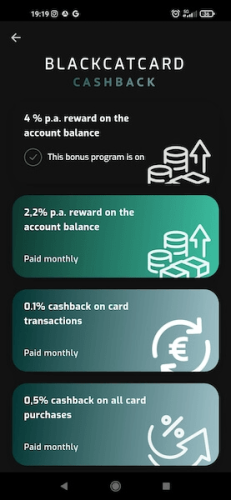

Cashback and Bonuses

Like with other payment cards, you can get cashback for using Blackcatcard, and all calculations and payouts are monthly. There are four programs to choose from, which are provided by FINTECH ASSETS OÜ:

| Cashback Program | Bonus | Min. Payout | Max. Payout |

|---|---|---|---|

| Passive income | Up to 4% p.a. reward | €0.10/mo | Unlimited |

| Google Play Market | 5% cashback | €0.10/mo | Unlimited |

| Amazon | 2% cashback | €0.10/mo | €50/mo |

| Card Payments | 0.5% cashback | €0.10/mo | €100/mo |

Fortunately, the company provides a simple calculator to help you understand how much you would get based on the amount in your account or your spending. Blackcatcard emails you additional promotions after you create an account.

Security

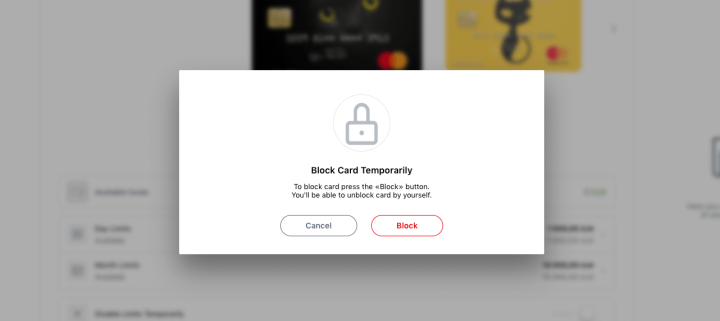

You would never trust your money with an insecure institution, and Blackcatcard is well aware of this, providing top-notch security to keep your earnings safe. Right off the bat, all transactions and operations are protected with 3D Secure protocol, ensuring no payments or transfers are made without your approval. For extra peace of mind, you can also enable push notifications for your cell to alert you whenever an operation is made.

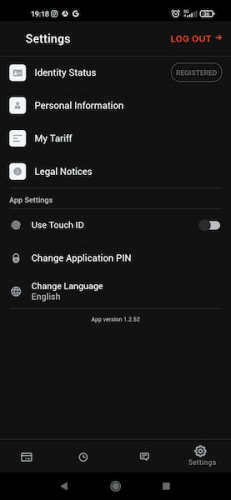

The platform also provides high security by requiring users to unlock it with a 6-digit security code, Touch ID, or Face ID. Plus, losing your card doesn’t need to be a big headache, as you can instantly block it via the mobile or browser app. Better yet, there’s the option to temporarily freeze the card if you think you’ve just misplaced it, helping you avoid the unnecessary reissuing of it.

As you would expect, Papaya Ltd. follows the privacy and security laws of Malta, which are some of the strictest. The company complies with the GDPR, so you can rest assured that your data will never be sold to third parties.

User Experience

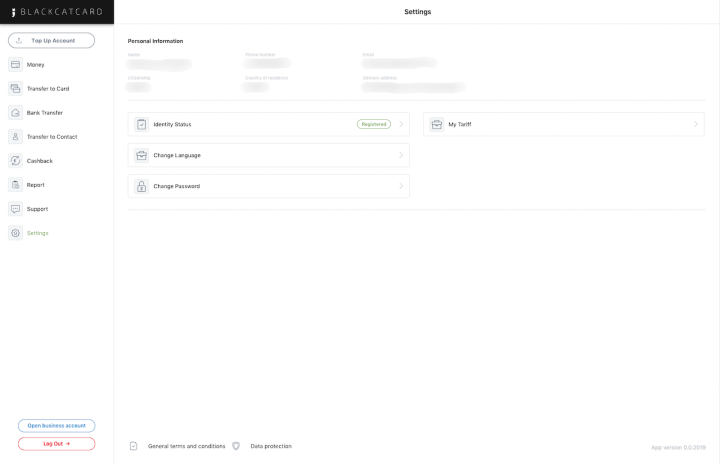

Creating an account with Blackcatcard is straightforward, but it takes a while since there are a lot of steps to go through. It’s also necessary to provide documents that prove you have an address in the EEA to get the card.

After creating the account, Blackcatcard will issue the prepaid card and send it to you. Standard delivery is free and takes up to 15-20 business days, depending on the location. It’s also possible to opt for express card delivery, which takes 1-5 business days, but keep in mind that it uses DHL, which is paid for separately.

When everything is in order, you can log into your account via the online platform or mobile app to manage all your money, including cryptocurrency.

Mobile App

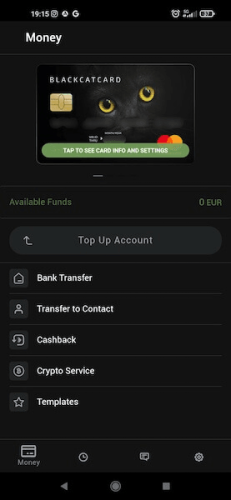

Blackcatcard’s mobile app (available for iOS and Android) provides a sleek interface that mirrors the online platform.

Everything you need, from bank transfers to crypto services, is just a few taps away, making it extremely straightforward to manage your money. As is typical with these kinds of apps, it’s possible to import phone contacts directly from your cell, simplifying money transfers. We were pleased that we could also create payment templates to make recurring transactions even more effortless.

Additionally, users can check transaction histories, get in direct touch with customer support, and update settings without leaving the mobile app. As a fun extra, a cute black cat pops up in the app from time to time.

Pricing

Creating an IBAN account, having a card issued, and then receiving it at home with standard shipping is free. In fact, most Blackcatcard services cost nothing. There are no account maintenance fees (unless you get an additional card), and online and mobile banking and card payments in EUR, SEK, CZK, PLN, and RON are free.

If you keep track of your transfers, payments, and cash withdrawals, it’s possible to use Blackcatcard without spending anything. However, it will cost you a small percentage of the money being moved if you go over the monthly limits:

| Cash withdrawal at EU ATMs | Up to €200/mo free | 1% of the value after limit |

| SEPA transfers | Up to 5 transfers/mo free | €0.20 fixed fee per extra transfer |

| Account maintenance fee | First card free | €2/mo for any additional cards |

| Card payments | Free for EUR, SEK, CZK, PLN, and RON | 3% for other currencies |

So, what’s the catch? Payments made in currencies other than those mentioned above have a 3% fee, which is higher than the competition. Cash withdrawals at ATMs outside the EU also incur a 1% fee of the money withdrawn, plus 3% for the exchange rate. Most cryptocurrency services are free with Blackcatcard, but the company takes 2% of every top-up, which is limited to 1,000 USDT per transaction and 5,000 USDT per day.

There’s a dormancy fee of €15 per month, which kicks in after seven months of inactivity. Fortunately, Blackcatcard is extremely transparent about its prices and doesn’t overwhelm users with the usual legal overload of information that other financial institutions provide.

Pricing for Business Accounts

For businesses, the scenario is different. Although incoming payments (SEPA) are free for companies located in certain countries, most transactions have an associated cost. The same applies to opening, activating, and closing an account.

Costs highly depend on the country where your business is based, so we recommend carefully going over Blackcatcard’s pricing page before opening an account.

Customer Service

Your money is a serious business, and if anything is affecting your ability to check or use your money, help needs to be one click away. Thankfully, that’s the case with Blackcatcard, which provides 24/7 customer support via live chat.

Your money is a serious business, and if anything is affecting your ability to check or use your money, help needs to be one click away. Thankfully, that’s the case with Blackcatcard, which provides 24/7 customer support via live chat.

If you prefer to find the answers, there’s also a detailed FAQ. From the registration process to crypto services, security, and money transfers, the help center covers everything you need to know about your account.

Moreover, the company is also available on most social media platforms, including Facebook, X, and Instagram. As a nice extra, it’s also possible to get in touch with Blackcatcard through Telegram.

Bottom Line

Depending on the country, seeing a black cat can be perceived as lucky or unlucky. With Blackcatcard, it’s not a question of luck. What you see is what you get, so there are no surprises along the way – which is essential when it comes to your hard-earned money.

Depending on the country, seeing a black cat can be perceived as lucky or unlucky. With Blackcatcard, it’s not a question of luck. What you see is what you get, so there are no surprises along the way – which is essential when it comes to your hard-earned money.

While EMIs might not provoke as much confidence as an actual bank for looking after your savings, Blackcatcard is a trustworthy service that makes money management straightforward.

The platform is highly secure, and it’s nearly impossible for someone to access your account illegally. The best part is that you don’t lose out on convenience, as one account is enough to manage the expenses of the whole family and any cryptocurrencies. That being said, Blackcatcard fees for currencies not on its list are higher than those of some competitors.

Creating a European IBAN account and getting your card is completely free, and you can start enjoying one of the four cashback programs available from day one.

* The bonus payment is a part of the Blackcatcard loyalty program provided by FINTECH ASSETS OÜ. Detailed terms and conditions can be found here.

** An integrated crypto exchange and custodial crypto wallets are provided by Blackcatcard’s partner Manerio UAB. You can find more information here.

Zed says

Blackcatcard is a scam. Sepa does not work, card payments are rejected so all your money is locked by them. Transaction history not available in app – you have to ask customer support to generate it for you. Keep away from this scam, be safe.

Daniel (Best Reviews Team) says

Hello Zed, and thank you for your comment! We’re sorry to hear about your experience with Blackcatcard. From what we could find, the company has been in the process of transferring SEPA service transfer providers, which has been completed. The next step is to connect its clients to use the SEPA payments in batches, so you should be able to withdraw your money in the near future. We hope your issue gets fixed soon. Have a great day!

Luc Van Geel says

Registered my account 2 months ago, and asked for express delivery of the card. Gave all the required information.

At this moment, I can open the app, but I still do not have an IBAN (so there is nothing I can do) and I haven’t seen the card yet. When I ask customer service when the IBAN will be fixed, they tell me to wait.

Daniel (Best Reviews Team) says

Hello Luc, and thank you for your comment. We’re sorry to hear about your experience with Blackcatcard. Our account was created quite fast, and the card arrived withing the company’s shipping expected times. Are you located outside of Europe? It would explain why it’s taking a bit more time. We hope your issue is fixed soon! Have a wonderful day!